As a Public Benefit Corporation, transparency is a common thread tying our missions together. From the outset we decided to share PLab financial data. You can find previous disclosures from H1 2015 (here) and Q3 2015 (here). Below are details about our burn rate from PLab’s first full calendar year of operations — January 1, 2015 to December 31, 2015:

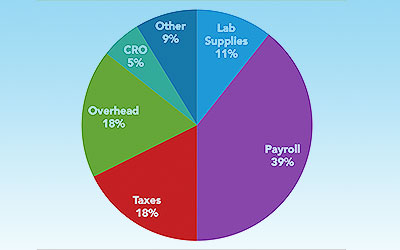

PLab monthly burn ranged from a high of $120,000 to a low of $78,000. 75% of our costs — payroll, overhead, taxes — are fixed. Variable costs include lab supplies, CROs and other expenditures, like business travel and legal fees. Lab supplies are consistently a small fraction of overall spend, in part a testament to low maintenance costs of model organisms. From Q1 to Q3, we were in the primary screening phase to identify leads compounds for Niemann-Pick C/NPC.

Once we hit that milestone with PERL101 we brought on consultants and CROs to guide us through the discovery and early preclinical phases, culminating in a 90-day maximum tolerated dose (MTD) study. Aravasc, Bayside Bio and Quintara Discovery were our preclinical CROs. Combined, we spent 5% of our annual budget on them, all in Q4. In total we spent just over $1 million in 2015. Here’s the cost breakdown. Note that categories have been simplified for this post and are more detailed in Quickbooks, our accounting software:

Overhead consists of QB3@953 rent, waste removal, insurance, and accounting, among other things. One of the expenses you’ll spend a lot of time debating, as covered in this Lab Manager Magazine article, is the renewal of service contracts. When you have equipment that costs $200,000, it’s worth it to spend $10-25k on a service contract. We were able to stretch a $25,000 service contract bill into quarterly installments.

In the “Other” category lawyers dominate. Legal expenses increased in Q4 as we prepped a provisional patent application. Elsewhere, we spent less on conferences and more on other areas of business development. As mentioned above, “Lab supplies” (11%) are fairly constant as an overall percentage of spend but the particular items vary as a program matures. For example, in Q4 we spent mostly on compounds and less on consumables such as 384-well plates. More scientist time was spent project managing outsourced experiments and interacting with consultants, and less time was spent in the lab.

Let’s dig a little deeper into PLab operations. On average, HappiLabs processed 2-3 orders per day for lab supplies and services. For the year, we placed 435 orders with 67 suppliers. It’s a time consuming process if you do it right, and that’s why we hired a Virtual Lab Manager to manage PLab. Read more about the process in this post.

Of the 67 suppliers, the top 10 accounted for 62% of our spend. Chembridge and Cayman Chemical were major providers of our compounds for screening and retesting. E&K Scientific is a local supplier for consumables, general lab supplies, and small equipment. They are about 40 miles south of our location at QB3@953. Buying from small local suppliers is in keeping with our environmental mission to reduce the carbon footprint of drug discovery. E&K’s proximity helps keep shipping costs low and makes shipping faster. (If you’re in the Bay area, give E&K a call, and tell them HappiTom sent you. You’ll get hooked up).

Amazon provides good pricing on some consumables (such as gloves), general lab supplies (lab notebooks, spatulas, petri dishes, etc) and many of our office purchases. Amazon Prime is well worth the $100/year for free 2-day shipping and easy returns. ThermoFisher provides reagents for the lab, but beware, their shipping costs are very high with a $44 “Handling” charge on almost every order. We avoid them when we can.

Each item in the lab is categorized below. It helps us track spending for different projects, and as we grow, we’ll better understand scaling costs. Chemicals are mostly hit or lead compounds. Consumables are dominated by 384-well plates from Greiner and sealing film from Axygen. We will say that we’re happy with Eppendorf’s new cell culture plates and pipettes. Services include sequencing and sample analysis from providers such as Sequetech, Rainbow Transgenic Flies, Praxair and providers through the marketplace Science Exchange.

That’s a summary of 2015 company and lab operations spending. We welcome comments and feedback, especially from other biotech founders and members of the rare disease community at large. An in-depth analysis will be part of PLab’s 2015 Annual Benefit Report, which will be released next month.