This week we announced a $7.4M equity financing. Endpoints News and STAT News covered the announcement and the Twitter angle. Here’s the backstory from the CEO’s vantage point.

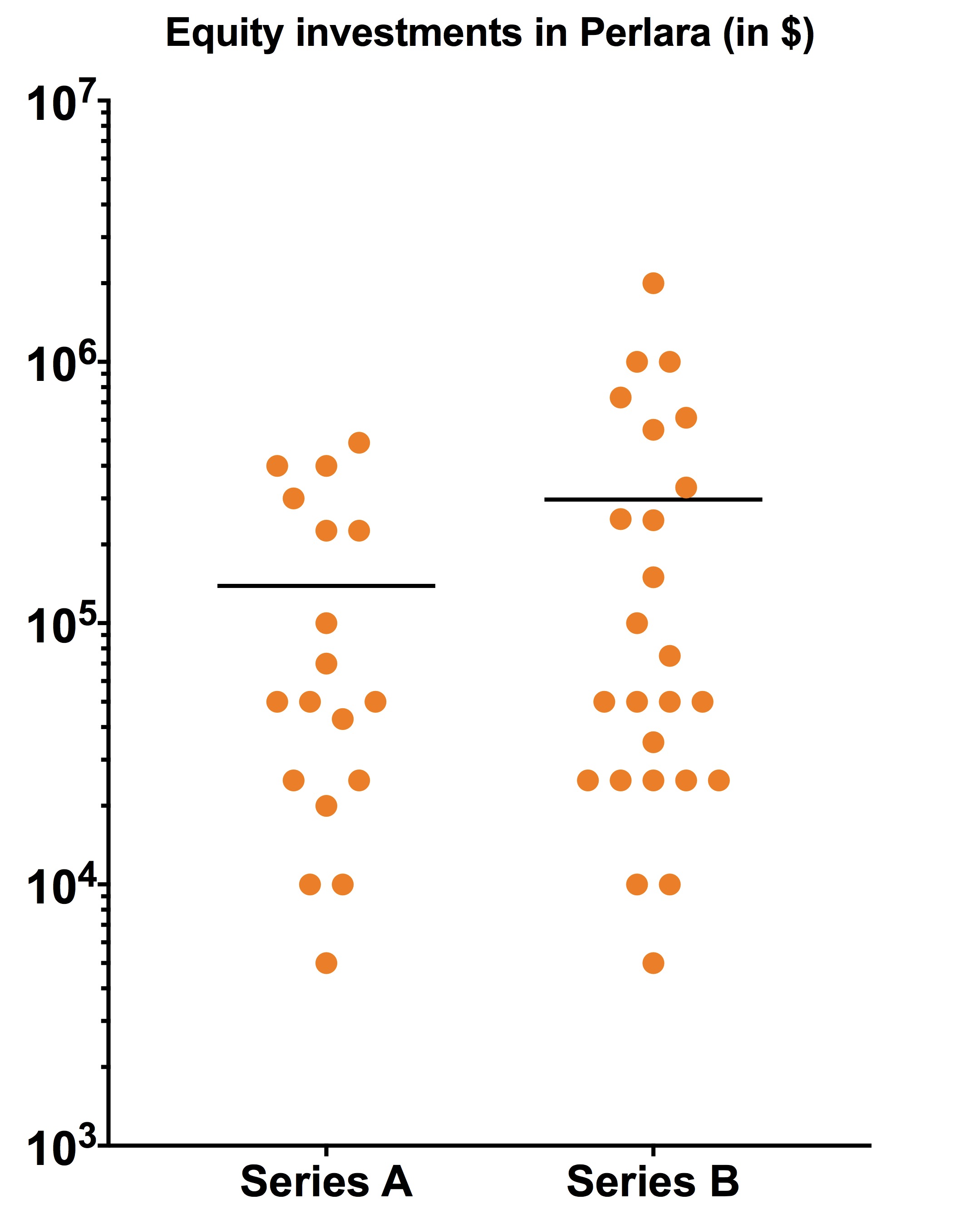

From the outside, this round appears to be our Series A. But it’s technically our Series B because it’s our second preferred equity financing since inception. This round is “leadless.” No institutional investors (VCs) participated. It’s a syndicate of existing investors and new investors: angels and super angels, US and sovereign family offices, micro VCs, startup accelerator, and strategic investor. Comparing the two rounds, the average investment amount doubles from $140,000 to $300,000 but the median investment amount is unchanged.

How did our Series B come to resemble our Series A? To answer that question I need to wind the clock back two years to December 2015. Perlara was still Perlstein Lab. We were pre-product, pre-revenue and pre-partnership. After 18 months of scientific progress, we had a lead series (PERL101) for Niemann-Pick Type C (NPC), and we were just beginning to characterize a new fly model of NGLY1 Deficiency as part of what became our first drug discovery partnership with a rare disease patient advocacy group. That work was the embryo that developed into PerlQuest, our core product. But we needed a bridge to get us to a validating Pharma collaboration and investment.

Enter Y Combinator, or YC. I mistakenly thought that Perlara was too old to apply to YC. Several founder friends and YC alums set me straight and I applied to the W16 batch. That was the best decision I’ve made as CEO. Although I wasn’t able to announce our first Pharma partnership at Demo Day in March 2016 , Perlara signed a lysosomal diseases research pact with Novartis in October 2016. And within two months of the Novartis closing, we launched our inaugural PerlQuests.

It took 30 months for a 12-slide seed deck to grow into a post-product, Pharma-partnered early-stage biotech company with revenues. In all my conversations with VCs up to that point, I was led to believe that those were the milestones a pre-Series A company had to attain in order to start bona fide Series A discussions. So at the start of this year I created a pitch deck and honed a pitch. My first pitch meetings started in mid-March.

Scores of Sand Hill Road rejections and passes and dead-ends later, I pivoted away from VCs and institutional investors and pivoted toward the company’s investor base. I worked my close founder network for targeted warm intros. I hustled like crazy all summer. A chance Twitter conversation led to an investment. The final closings were last month. Fundraising mode could be switched off – for now.

In 2018 I’ll be singularly focused on three big goals: (1) profitability; (2) tripling the number of PerlQuests; (3) advancing our current PerlQuests into preclinical development.